Nissan, one of the most recognized Japanese automotive brands globally, is finding itself under increasing pressure as it grapples with a mix of economic, strategic, and operational challenges. Once hailed for innovation, fuel efficiency, and affordability, the brand now faces a series of internal and external storms — from declining global sales to intense market competition and shifting consumer preferences.

As the global auto industry rapidly transforms, “dark clouds” indeed seem to be gathering for Nissan. Here’s a detailed look at the factors contributing to the brand’s current struggles and what it might take for Nissan to weather the storm.

1. Declining Global Sales Performance

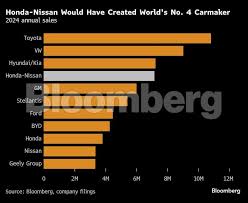

Nissan has experienced a noticeable dip in global vehicle sales in recent years. The brand, which once enjoyed robust market presence in North America, Europe, and parts of Asia, has seen demand wane.

Key Statistics:

- Nissan’s global sales fell by over 10% in 2024 compared to 2023.

- Its U.S. market share has shrunk, especially with competitors like Toyota, Honda, and newer EV makers taking center stage.

- In emerging markets like South Africa and India, Nissan’s presence is minimal compared to competitors.

This decline is partly attributed to an aging product lineup, inconsistent marketing, and a lack of high-demand vehicles like hybrids, SUVs, and full EVs in many regions.

2. Lagging in the EV Race

Electric vehicles (EVs) represent the future of the auto industry, but Nissan is not keeping pace with the likes of Tesla, BYD, Hyundai, or even fellow Japanese rivals like Toyota and Honda.

Although Nissan was one of the early players in the EV market with the Nissan Leaf, it failed to build on that early success. While others have aggressively expanded their EV lineups and invested heavily in battery tech, Nissan has been seen as conservative and slow-moving.

Issues:

- Limited EV model options globally

- Minimal presence in premium EV segments

- Fewer investments in next-gen battery platforms

With global EV sales soaring, Nissan’s underwhelming strategy is proving costly.

3. Leadership and Strategic Uncertainty

The arrest of former CEO Carlos Ghosn in 2018 plunged Nissan into a leadership crisis. Ghosn had been credited with turning the brand around in the early 2000s, but his departure revealed deep-rooted issues within the company’s structure and strategic direction.

Since then, the company has undergone several executive changes, with conflicting visions leading to delayed decision-making and unclear brand messaging. This internal turbulence has also strained its alliance with Renault and Mitsubishi, which was once considered a strategic strength.

4. Product Lineup Concerns

Nissan’s current product portfolio is not resonating with global consumers in the way it used to.

- Many of its vehicles, including the Sentra, Altima, and Maxima, are now considered outdated compared to rivals.

- The compact and midsize SUV segments — currently among the most lucrative — are dominated by Toyota (RAV4), Hyundai (Tucson), and Ford (Escape), leaving Nissan’s Rogue and Qashqai struggling to maintain relevance.

- In South Africa, Nissan’s older NP200 remains popular, but the brand lacks newer high-tech models to appeal to upwardly mobile consumers.

5. Rising Competition from Chinese Automakers

A key threat that Nissan and other traditional brands are facing is the rapid expansion of Chinese automakers, particularly in value-driven markets like South Africa, India, Southeast Asia, and Latin America.

Brands like GWM, Chery, Haval, and BYD are offering modern, feature-rich cars at aggressive price points, backed by strong marketing and aftersales support. Nissan’s mid-range offerings are being squeezed out as a result.

6. South African Market Challenges

In South Africa, where the automotive market is shaped by affordability, durability, and local assembly benefits, Nissan faces the following issues:

- Fewer new model launches compared to rivals like Toyota, VW, or even new entrants like BAIC and Proton.

- Weak aftersales service and dealership support in certain regions.

- Lack of investment in locally-produced hybrid or electric vehicles.

Despite having a plant in Rosslyn, Pretoria, there’s been criticism around underutilisation and missed export opportunities.

7. Shifting Consumer Preferences

Today’s auto buyer is looking for:

- Connectivity: Built-in infotainment, mobile integration, and app-based vehicle control.

- Sustainability: Hybrid or EV powertrains.

- Advanced Safety: ADAS features, 360-degree cameras, and lane assist.

While Nissan offers some of these in select models, the majority of its lineup lacks the technological edge that’s become a standard expectation even in mid-range vehicles.

Can Nissan Make a Comeback?

While Nissan’s challenges are substantial, the company is not without hope. It has taken some steps toward reinvention:

New EV Investments:

- Nissan has committed to investing $17.6 billion (R330 billion) in EV development over the next five years.

- New models under the Ariya brand and EV platforms are in development, targeting a 2030 carbon-neutral goal.

Strategic Restructuring:

- Cost-cutting initiatives and withdrawal from unprofitable markets are expected to improve margins.

- Rebranding efforts and a renewed push in North America, Japan, and parts of Asia may help.

Strong Brand Equity:

- Despite its current struggles, Nissan remains a trusted name for reliability and value.

- With the right leadership and aggressive innovation, the brand could pivot successfully.

Conclusion

Nissan stands at a critical crossroads in its history. Once a leader in innovation and early electric mobility, the brand now finds itself playing catch-up in an increasingly crowded and competitive market. With internal challenges, external pressures, and an evolving customer base, the “dark clouds” gathering for Nissan are not without warning.

However, history has shown that automotive giants can rebound — if they act decisively and embrace change. Whether Nissan will rise above the storm or be further eclipsed by nimbler competitors remains to be seen.

Leave a Reply