South African motorists can look forward to some relief at the pumps this week, as official data confirms a drop in fuel prices starting Wednesday, 5 June 2025. This marks a continuation of recent trends, driven largely by a stronger rand and more stable global oil prices.

Fuel Price Changes Effective 5 June 2025

- Petrol 93 (Inland): Decreases by 5 cents to approximately R21.24 per litre

- Petrol 95 (Inland): Decreases by 5 cents to approximately R21.35 per litre

- Diesel 0.05% (Inland): Decreases by 37 cents to around R18.53 per litre

- Diesel 0.005% (Inland): Decreases by 37 cents to about R18.57 per litre

- Illuminating Paraffin: Drops by 56 cents per litre

- LPGas: Drops by 89 cents per kilogram

Prices in coastal regions are typically lower due to reduced transport and distribution costs.

Main Drivers Behind the June Fuel Adjustments

1. A Stronger Rand

One of the key factors behind the decrease is the performance of the rand. Between 2 May and 29 May, the rand averaged R18.11 against the US dollar — stronger than the previous month’s average of R18.84. This appreciation helped reduce the cost of importing crude oil and refined fuel products.

2. Lower Global Oil Prices

Brent Crude oil prices saw a slight decrease, averaging around $83 per barrel. This is a notable improvement from earlier months when geopolitical tensions drove prices higher. A lower international oil price directly impacts the Basic Fuel Price (BFP), resulting in cost savings passed down to local consumers.

3. Impact of Tax Adjustments

Despite the fuel price drop, the recently implemented fuel levy hikes introduced in May’s Budget Review are now in effect. These increases are as follows:

- General Fuel Levy: +16 cents per litre (petrol)

- General Fuel Levy: +15 cents per litre (diesel)

These tax hikes have partially offset what could have been larger reductions at the pump.

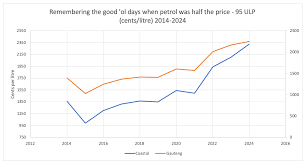

Year-on-Year Fuel Price Comparison

Comparing this June’s fuel prices to the same period last year highlights significant savings:

- Petrol 95: Down nearly R2.90 per litre

- Petrol 93: Down approximately R2.67 per litre

- Diesel: Down about R2.43 per litre

These lower prices have helped reduce pressure on consumers, particularly in a challenging economic environment where inflation has been top of mind for households.

Economic and Inflationary Impact

The drop in fuel prices contributes positively to the broader economy. Transportation costs play a major role in influencing the prices of goods and services, and any drop in these costs eases inflationary pressure.

Lower fuel prices in May and June have been a contributing factor in the South African Reserve Bank’s decision to cut the repo rate by 25 basis points. Analysts suggest that continued reductions could support further economic stimulus efforts in the second half of 2025.

Outlook for the Rest of 2025

The medium-term outlook for fuel pricing in South Africa will hinge on several unpredictable elements:

- Exchange Rate Volatility: The value of the rand remains subject to global economic sentiment, interest rate changes in major economies, and domestic political developments.

- Oil Price Movements: While current trends are stable, geopolitical risks in major oil-producing regions like the Middle East or production shifts by OPEC+ members could result in sharp price increases.

- Local Taxation Policies: Any adjustments to the Road Accident Fund levy or additional fuel-related duties could influence the pricing structure in the coming months.

Consumers are advised to continue monitoring monthly fuel price announcements and plan budgets accordingly, especially those in the logistics, agriculture, and travel industries where fuel is a major operating expense.

Conclusion

For now, motorists can breathe a sigh of relief as fuel prices dip slightly to start the month of June. While the reductions aren’t dramatic, they provide some welcomed relief amid the ongoing cost-of-living pressures. Whether this trend will hold through winter remains to be seen — but for now, the tank fills a little cheaper this week.

Leave a Reply